Bluzelle Staking Economics

Bluzelle uses a "Proof of Stake" method to ensure the integrity of the network. Validators are required to “stake”, or “put up” a minimum number of tokens into. The validator is able to participate in Bluzelle as a validator. Their “power” as a validator relates to how much of a stake they have put up, with respect to the total cumulative stake of all the validators in the zone.

Bluzelle attracts people to become validators by offering them part of the revenue Bluzelle charges customers for storing data on Bluzelle. As a result, staking is critical to ensure the integrity of validators. Validators are required to “stake”, or “put up” a minimum number of BLZ tokens into. Their “power” as a validator relates to how much of a stake they have put up, with respect to the total cumulative stake of all the validators in the zone. Their power affects how much of the rewards they earn.

For example, Bob puts up 10,000 BLZ tokens and the total # of tokens staked is 100,000 - Bob has 10% of the power. This means that his node provides 10% of the voting power, and he also earns 10% of the total revenue available. Revenue comes from all the fees paid by developers who use the database. The higher your stake, the more you will earn.

Poor behaviour (intentional or unintentional) by a validator can result in slashing. Slashing, considered the deterrent to bad behaviour, involves a penalty in tokens applied against a validator’s stake. It serves to ensure that nodes act responsibly and for the good of the network.

The Incentives

For providing the aforementioned functions, validators will be paid a portion of the network fees Bluzelle gets from customers. Bluzelle has allocated 10% (50M) of its token supply to compensate validators for being part of Bluzelle to kickstart the network.

Total Rewards from Staking = Block rewards + Staking Rewards from Bluzelle Community Incentivised Pool

Over four years as transaction fees grow, we expect the Community Incentivised Pool to decrease year over year. In the long run, the network is intended to sustain itself on the basis of transaction fees.

The portion of transaction fees that are distributed to validators has yet to be determined. Bluzelle will pick an amount that is high enough to provide positive income for validators and high enough for Bluzelle to support its network.

Below, you will learn how Block rewards & the staking rewards from the Bluzelle Community Pool is calculated.

Staking Rewards from Bluzelle Community Incentivised Pool

This part of the reward is what the Bluzelle team has purposely allocated to incentivise the community to participate in the network at early stage. It is distributed on a daily basis and will be distributed directly on your available balance.

Rewards Pool

Bluzelle has allocated an annual BLZ rewards pools that will decrease over time. These allotted rewards represent 10% (50M) of the total supply over four years. Unallocated rewards from the previous year will be rolled to the next year.

Year

Rewards Pool (BLZ)

Percentage of Supply

1

20M

4%

2

15M

3%

3

10M

2%

4

5M

10%

Total

50M

10%

Yield

The targeted APY for Bluzelle staking is 25% APY. This is equivalent to 0.06115% daily yield. We also assume that all staking rewards are re-invested diligently, which means as soon as you receive your staking rewards, you stake all of them back into the pool. Every day, our mechanism guarantees that the total rewards for the whole community pool is 0.06115%. That means if the whole pool has 10 million tokens staked, the total reward pool for the day will be 6115 BLZ. However, how much of each individual will share from the total reward pool will vary from each other, depending on the staked amount as well as length of stake, which is explained in the below section.

Mathematics

It takes a few steps to determine how much each individual should receive every day. Here, we assume Alice & Bob are the only two participants.

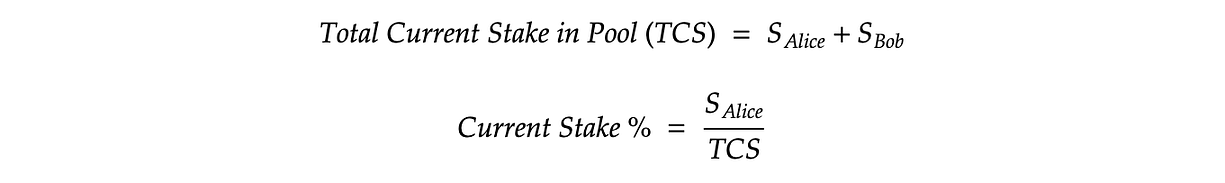

Step 1. Look at the proportion of an individual’s stake against the total stake in the pool on the current day.

Here, S represents the staked amount that Alice & Bob is holding on the current day. This value only represents the current state and does not matter when you put in the stake.

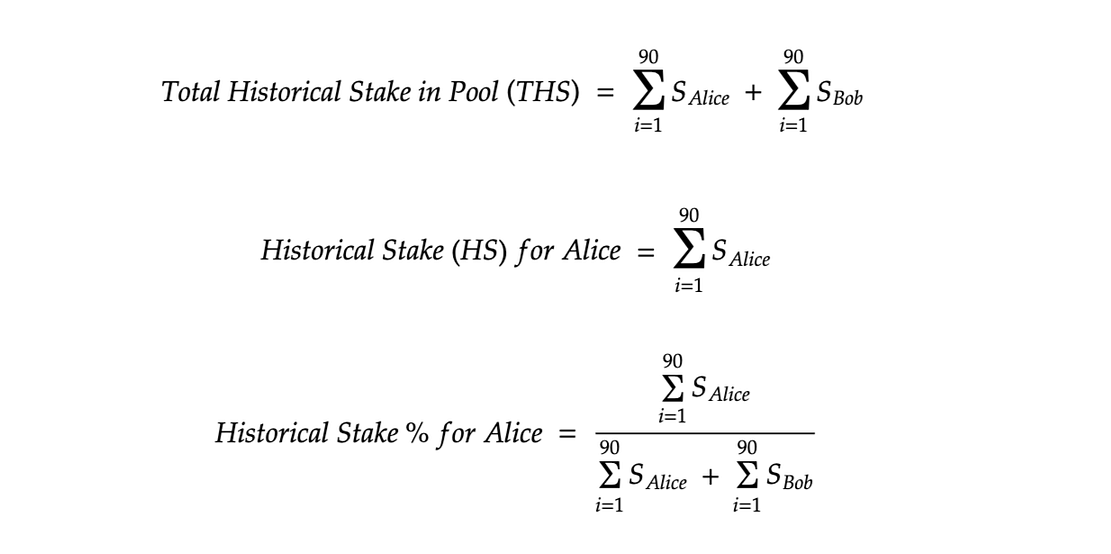

Step 2. Look at the proportion of an individual’s staking history against the full staking history over the past 90 days.

The historical stake is the running totals of the daily stakes for the past 90 days.

Step 3. Divide daily rewards pool for individuals

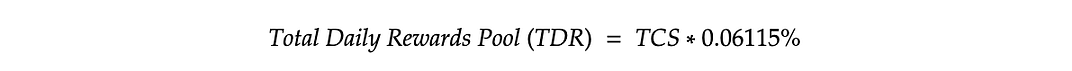

Total Daily Rewards (TDR) that the whole pool will receive is 0.06115% based on the TCS today.![]()

Among the TDR, 25% of it is shared proportionally based on Current Stake %, while 75% of it is shared proportionally based on Historical Weighted Stake %. Therefore, the rewards for Alice will be computed as:![]()

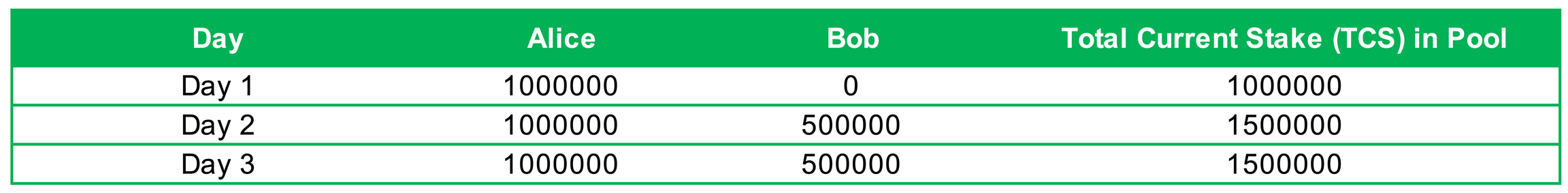

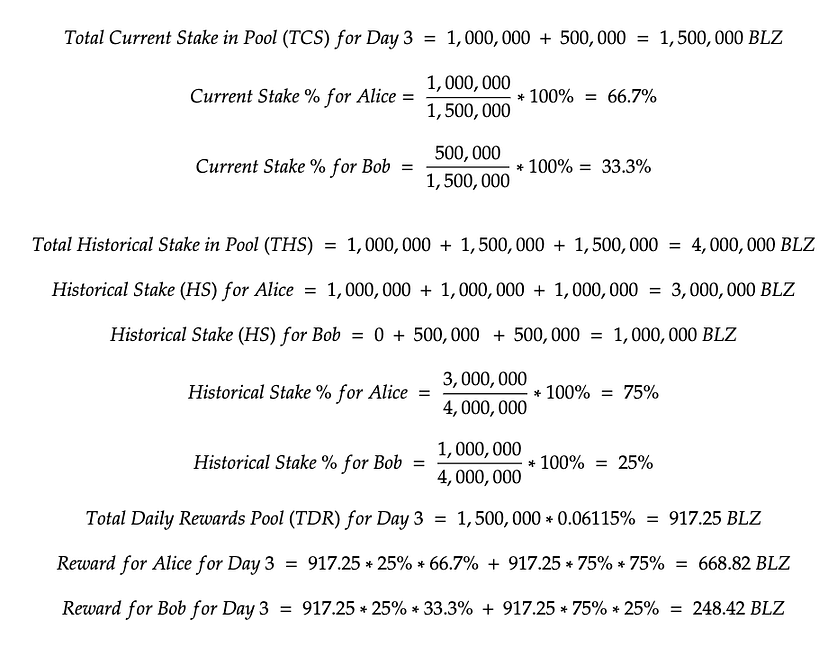

Now let’s take an example to understand how these formula work. Below is the staking status of Alice & Bob each day.

Now, based on the data, let’s calculate how much Alice & Bob will receive on Day 3:

From the above, we can see that Alice actually yields 0.06682% (equivalent to 27.6% APY) on day 3, which is higher than the community target of 0.06115%. This is how the stake amount & tenure come into play.

Below, we will go through 3 different scenarios to understand how your daily earnings can be impacted by the staked amount, tenure, and also activities of other participants.

Examples

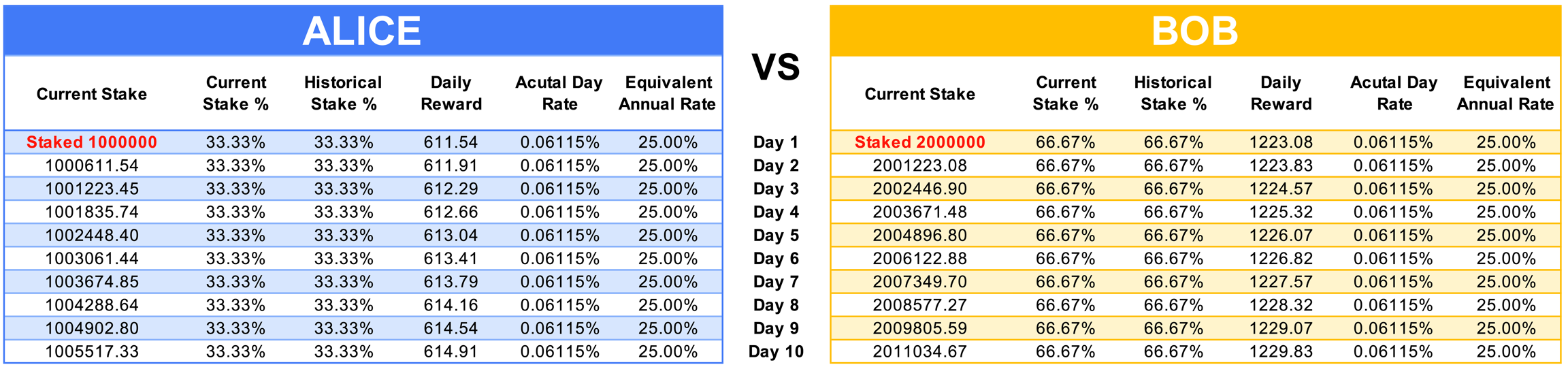

Ex 1. Stake on same day, different amounts

Alice & Bob staked 1,000,000 & 2,000,000 BLZ respectively on Day 1. We assume Alice & Bob re-invested their daily rewards automatically (Today’s stake is the sum of previous day stake + previous day reward). Therefore, Alice & Bob’s current stakes increase daily.

The above table showed that both yielded the same rate at 0.06115% on a daily basis. However, since Bob has a larger stake, he also receives higher rewards proportionally.

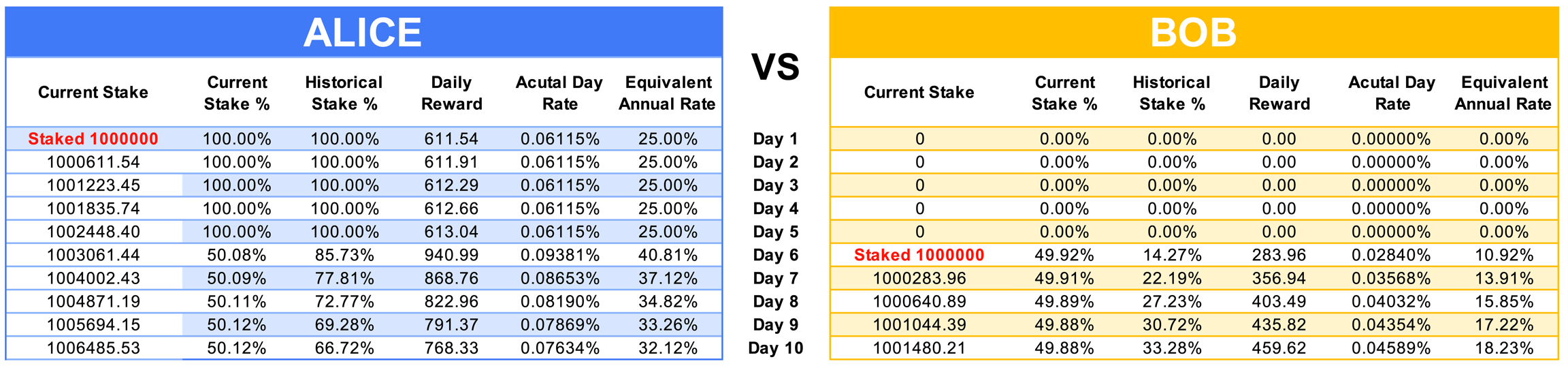

Ex 2. Stake on different days, same amount

Alice staked 1,000,000 BLZ on Day 1 while Bob only stake 1,000,000 BLZ on Day 6.

From the above table, it shows that when Bob contributes to the pool on Day 6, Alice’s daily yield also jumps up. This is because the total staking pool increases. Even though Alice & Bob put in the same stake, Alice has a higher historical stake % because she started staking earlier, leading to a higher daily yield than Bob. As Alice & Bob hold their stakes longer, their actual day rate will gradually regress to 0.06115% and becomes stable afterward.

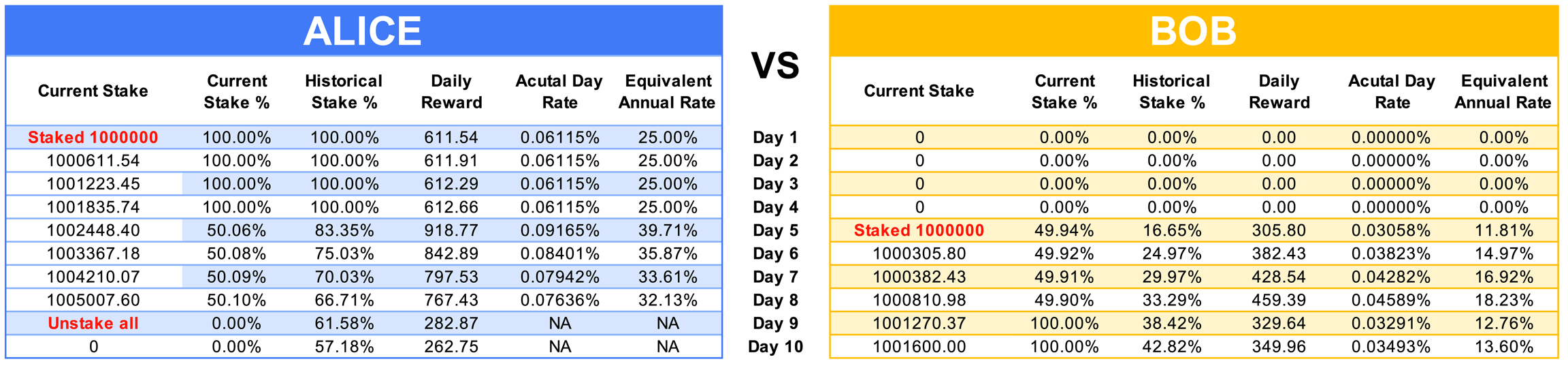

Ex 3. Unstaking from the pool

Alice staked 1,000,000 on Day 1. Bob staked 1,000,000 on Day 5. Alice then unstaked everything on Day 9.

From the above table, it shows that even though Alice unstaked everything on Day 9, she still receives daily reward because she still shares a historical stake % from the previous 9 days. Her rewards will gradually decrease to 0%. Bob’s yield also decreases due to Alice leaving the pool.

Conclusion

Now, you all understand that your reward is determined by the current state as well as the past 90 days activities of the whole pool. It’s difficult to project the yield for tomorrow, next month, or the whole year because it is highly impacted by any future activities. The formula and above examples imply that:

The higher stake you have, the higher daily rewards you get compared to other participants in the pool

The longer you hold your stake, the higher daily rewards you get compared to other participants in the pool

If more stakes are contributed to the pool, you get higher daily rewards as well

If you unstake, you still earn some rewards because your past 90-day staking history still takes effect. Your daily rates will slowly regress to 0% till 90 days after you unstake.

There are several advantages of Bluzelle’s complex staking model:

Rewards are distributed on a daily basis and become immediately available upon receipt. Participants have the freedom to withdraw or re-invest your daily rewards

By staking earlier and longer, you get the opportunity to earn more than 25% APY

There is a network effect. The more people join the staking pool, the higher yields people can get. This will incentivise more participants to stake or invite others to do so.

Block Rewards

BLZ token holders are able to stake their BLZ tokens to Bluzelle. In doing so, they provide the critical security needed for the network. In return for doing so, they earn block rewards. These rewards come 100% from the total of all the fees paid for all the transactions on that block. As soon as a token holder stakes tokens, they start to receive a portion of the rewards associated with the validators they have staked with.

A validator operator also earns rewards this way, just like a delegator. As described below, validators operator also earns commissions. These commissions are the primary incentive to be a validator.

Rewards are always paid in BLZ tokens.

Commissions and Risks

Validators are free to set their commission levels, from 0% up to 20% (subject to change). As described below, the block rewards calculated for each delegator have the commission taken out of them and this commission is paid directly to the validator operator. Whatever is left, post-commision, from the block reward, is proportionally paid out to the stakers.

Mathematics

Without going into the specifics, every block, a “block proposer” is chosen, who gets to earn a bonus on top of the regular rewards. This bonus can range from 1% to 5%, depending on the amount of effort the block proposer made in securing the block.

We will follow here an example that we were inspired upon, from the COSMOS community. We have skipped concepts like the community pool and taxes, for the sake of simplicity.

Let’s use the following assumptions:

10 Validators (1 block-proposing validator + 9 normal validator).

Each Validator has a 1% commission.

Each Validator has self-staked 20% of the total stake they have. So, 80% of their stake is held by delegators. We will use 20% and 80% below correspondingly.

Each validator has 20 delegators, and each has staked the same amount.

The block we are analyzing collected 1005 BLZ in fees (total gas collected from all the transactions included in this block).

The block proposer did the work necessary to earn the full bonus of 5%.

Let’s assume X is the # of tokens each normal validator earns for its gross reward pool. Therefore, the block-proposing validator will earn (1+5%)X.

Now we can solve the following simple algebraic equation:

X * 9 + (X + X * 5%) * 1 = 1005

=> 10.05X=1005

=> X = 1005/10.05 = 100

For the block-proposing validator:

Total Reward Pool: 100 + 5% * 100 = 105 BLZ

Commission: 105 * 20% * 1% = 0.84 BLZ

Validator Operator’s Reward: 105 * 20% + Commission = 21 + 0.84 = 21.84 BLZ

Total Delegator Reward Pool: 105 * 80% - Commission = 84 - 0.84 = 83.16 BLZ

Each Delegator’s Reward: 83.16 / 20 = 4.158 BLZ. The pool is divided up proportional to each delegator’s stake.

For the non-block-proposing validator:

Total Reward Pool: 100 BLZ

Commission: 100 * 20% * 1% = 0.8 BLZ

Validator Operator’s Reward: 100 * 20% + Commission = 20 + 0.8 = 20.8 BLZ

Total Delegator Reward Pool: 100 * 80% - Commission = 80 - 0.8 = 79.2 BLZ

Each Delegator’s Reward: 79.2 / 20 = 3.96 BLZ. The pool is divided up proportional to each delegator’s stake.

Reward Payout

Rewards are paid out automatically to each delegator, each block, which is approximately every 6–7 seconds. Once paid, these tokens are in a “rewards pool” for each delegator. The delegator must explicitly transfer these tokens out of their rewards pool to their main account before these reward tokens can be used (by “Claiming Rewards” on the dashboard). Once in the main account, these tokens can be withdrawn (via the bridge) or staked anew to validators to compound the delegator’s benefits.

Optimizing Rewards

Below are some tips and best practices that can help you maximize the block rewards you can earn:

Be critical in your selection of validators. Research each wisely, look at their statistics including their CENSUS stats, previous slashings, and community opinion. Don’t always go for validators with low commissions. You often DO get what you pay for.

Diversify your portfolio by spreading your tokens out across 4–6 validators that you have vetted.

Immediately and regularly claim your block rewards and stake them anew to your chosen portfolio of validators. Tokens do NOT earn rewards when they sit in the rewards pool — only when staked. Take maximum advantage of the power of compounding and maximize your returns!

Last updated